Investing in Superstars

This is the first in a four part series. The other are here: part 2, part 3, part 4.

Imagine you are in your early twenties, out of college several years and your best friend, who recently came into an inheritance of $300K cash told you they could think of no better way to invest the money than to invest it in you. Not the company you started, not as a loan, but invest it in YOU, as if you were a startup. In return your friend said all they wanted was 3% of your gross income for the rest of your life. Do you think you would take it?

Now what if your friend said that they didn’t care what you did with the money or how much you made each year. If you wanted to sit on a beach in Nicaragua learning to surf, go work in the Peace Corps, stay at home and do your art projects, whatever you want it would be fine, just as long as you made sure to always pay the 3% of whatever you make (as little as that may be).

And finally, what if your friend said you could buy out of your obligation at any point for $6 million in cash. Then would you take the deal?

. . .

Personal Investment Contracts

. . .

Phil Gordon and I recently made such an investment in a person we both know very well, call her Marge. The thing about Marge is that she’s one of these people you know — you can feel it in your bones — that she’s a superstar. She may have a string of projects and startups that don’t end up producing much in terms of tangible results — in fact she already has. But you know that all of this “failure” is simply building Marge’s brand equity. She’s learning how to navigate in the world, how to build value (whether it be monetary value, social good, or however you define it). She’s also making connections with people who are taking notice of her talent, love her undefinable qualities as a person, and who just want to somehow help her succeed in her life’s mission and be a part of her success. Everyone who meets Marge knows it’s simply a matter of time before her success is tangible. Maybe she’ll end up as a founder of a billion dollar startup, maybe her book will top the NY Times Bestseller list, maybe she wins a MacArthur Genius award. Or maybe over the 40+ years of her career doing what she absolutely loves and was made to do, she will touch the lives of millions of people.

From our perspective as investors, it doesn’t really matter what path Marge chooses or what twists and turns that path reveals. We’ve already determined that she’s a winner and she will adapt accordingly. The cash investment was intended to smooth out the earnings curve so that Marge won’t have to take jobs that don’t further her life goals just so she can eat and pay rent. And even if she blows through the cash, she’s still gotta eat and pay rent, which means she will find a way to make money (while pursuing her dreams). Maybe one year she makes $10K. Down the road she herself inherits some money and coincidentally that same year is paid handsomely on a consulting gig and ends up making $400K. Or perhaps she finds that she loves climbing the corporate ladder and steadily increases her salary from $50K to $500K over the course of 20 years. Assuming Marge makes an income of some sort for 40 years, she only has to average $250K (in today’s dollars) for us investors to get our money back.

Now here’s were it gets interesting for the investors. It’s very unlikely that we will be negative on our investment over the course of Marge’s lifetime, unless she dies or becomes incapacitated (which happens of course; there’s no such thing as a risk-less investment). And in poker parlance, we are “freerolling” to make a substantial return if she hits it big and/or she decides she wants to buy out. But even if we don’t make a ton of money off of Marge, we know that our investment will have made a significant positive impact on the world. Why? Because we hand-picked her as “the one” out of the thousands of people we’ve met over the years to invest in. Amongst those other there are surely many winners, they’re just not… Marge.

. . .

Simple, Flexible

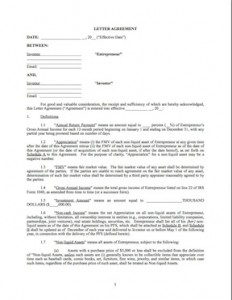

You are welcome to download and use the document above as you like, it’s hereby placed in the public domain. Obviously Phil and I have to disclaim any responsibility for what you do with it, and we cannot give you any legal advice. We are very comfortable that we are not breaking any laws or regulations and we’ve had a team of lawyers and personal agents vet and refine the basic template from both the investor’s standpoint and the investee’s.

And sorry, we are not accepting applications nor will we consider investing in you. But if you have people who believe in you and trust you as much as Phil and I do in Marge, then show them this blog post and convince them to invest. The Personal Investment Contract (PIC) can be calibrated for just about any situation where the investor believes the person they are investing in is (a) a true superstar, and (b) completely trustworthy. Here are the key numbers to keep in mind:

- Investment Amount - This should be determined by the entrepreneur such that they feel like they have enough breathing room to pursue their passion for at least a couple of years, or longer if they feel like supplementing their income themselves.

- Annual Return Payment - The idea is keep this low enough so as not to be a burden on the entrepreneur, but high enough to be attractive for the investor in combination with the Termination Amount.

- Termination Amount - If the ARP is low, this should be high; if the ARP is high, this should be low. It’s the slider that trades risk for reward.

. . .

Examples PICs

- Example 1: Technologist or Business Person

- Investment: $250K

- ARP: 2%

- Buyout: 10x ($2.5M)

- Example 2: Social Entrepreneur

- Investment: $150K

- ARP: 5%

- Buyout: 5x ($750K)

- Example 3: Do Gooder or Research Scientist

- Investment: $100K

- ARP: 10%

- Buyout: 1x ($100K)

. . .

Important Details

Despite the fact that the contract is ridiculously simple (three pages!), there are some key details in the contract that we believe make this work. The first is the clause that says the entrepreneur has to give the investor a year’s notice that they intend to buy out. This is so that the investor can’t be cut out of a big, pending deal that closes soon after the entrepreneur buys out. It’s possible that the entrepreneur gives notice but for whatever reason (turn of fortune?) can’t come up with the cash required a year later. That’s fine, the contract stays in effect and the entrepreneur can give notice again in the future.

The second important detail is that the Termination Amount isn’t really just the buyout multiple on the original investment but it also crucially includes the ARP times the net fair market value of all unrealized gains made during the course of the contract. The reason for this is as follows. What happens if the entrepreneur buys a house or invests in a business which becomes the dominant (or even just a significant) portion of their net worth by the time they want to buy out. The investor rightly feels like they contributed to that gain and should get their fair share. The entrepreneur may not want to (or even be able to) realize the gain at the time of the buyout, e.g. they still want to own and live in the house, or the business they invested in isn’t public yet. But the investor shouldn’t have to take the worst of the deal. Hence the fair market value assessment is made (by third party arbiter if necessary) and the investor gets paid. For instance, consider a PIC using the numbers from Example 1 above. Entrepreneur buys some property that appreciates by $20M, so the actual Termination Amount becomes ($20M x 2%) + $2.5M = $2.9M.

There are sure to be loopholes that we didn’t close, and it would be great if you could bring those up in the comments section below so the template can be adjusted or variants of the PIC can be made. Ultimately we decided that because we are investing in people we can trust, and we want to foster that sense of trust and fiduciary obligation, it was better to have the contract be short and to the point, rather than cryptic and air-tight. Yes, there could be problems down the road, but then again if one party really wants out of a contract or wants to bend the rules in their favor they will be able to. We’d rather enter into a handshake agreement where we are partners in the success of a budding superstar — as motivated to help them achieve their goals as they are to leverage our resources, experience and connections — than to take advantage of someone because of their temporary circumstances.

. . .

Replicate, Don’t Grow

The first thing that angel investors or venture capitalists think about (once they decide they like the model) is how can they create a fund to achieve scale. Caution! This way there be dragons. A PIC is fundamentally a personal investment reliant on mutual trust and respect, not a mechanical device suited to turn into a factory. PICs can achieve scale, but it will happen from the bottom up, rather than top down. That is, they are meant to replicate, not grow.

. . .

Feedback

If you have any feedback or experience with this sort of investment, we’d love to hear it! Share your stories in the comments below.

. . .

Related posts:

Alternative Institutions, Incentives, Innovation, Investing, Social Entrepreneurship, Trust

Alternative Institutions, Incentives, Innovation, Investing, Social Entrepreneurship, Trust

Archives

- July 2015

- July 2014

- January 2014

- March 2013

- July 2012

- April 2012

- February 2012

- December 2011

- November 2011

- October 2011

- August 2011

- May 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

Pingback: Now this is interesting! Making investments in individuals=Genius? « the.everyday.me.()

Pingback: links for 2009-10-31 « Blarney Fellow()

Pingback: Investing in Superstars Pt. 2 | Michael Karnjanaprakorn()

Pingback: If I Started an Investment Fund | Michael Karnjanaprakorn()

Pingback: Social Enterprise | Mainstream Medicis()

Pingback: How Much Is the Rest of Your Life Worth? | SocialButterfly()

Pingback: ¿Hipotecarías tus ingresos de por vida? | Francisco Polo()

Pingback: Investing in People is the Game We Play « Growth Partner Entrepreneurship Blog()

Pingback: Investing in Tomorrow 2.0 « James Oickle()

Pingback: Investing In Our Geeklets: A Methodology @ Technology News()

Pingback: Investing In Our Geeklets: A Methodology - InfoSmell.com()

Pingback: links for 2010-03-04 | LaptopHeaven's Blog()

Pingback: How to REALLY Invest in People | SocialEarth()

Pingback: Epistemology 2.0: Reputation Engines, Peer Review, and the Funding of Open Science | Open Science Summit()

Pingback: a quiet revolution: listen carefully()

Pingback: Assault on the Senses.com()

Pingback: Quora()

Pingback: Toptrend 1: creatieve financiering — Sociaal Ondernemen. Nu!()

Pingback: Buying equity in people | Felix Salmon()

Pingback: Buying Equity In People : Two Letter Worlds()

Pingback: Sonali Mukherjee: A drought of action in a sea of reaction | Chris Gagné()

Pingback: IQ FINANCIERO | Hay que invertir en ‘rockstars’.()

Pingback: Angels & Term Sheets | StartWise Blog()

Pingback: From $100 Million to Broke to Betting It All on Cryptocurrencies - ExploreAbout.com()

Pingback: From $100 Million to Broke to Betting It All on Cryptocurrencies… | Startup Scapes()

Pingback: From $100 Million to Broke to Betting It All on Cryptocurrencies | Tshwi-fi()

Pingback: From $100 Million to Broke to Betting It All on Cryptocurrencies - Synergy Capital()

Pingback: From $100 Million to Broke to Betting It All on Cryptocurren… | The Startup Times()

Pingback: From $100 Million to Broke to Betting It All on Cryptocurrencies… | Journal Startup()

Pingback: From $100 Million to Broke to Betting It All on Cryptocurren… | Startups Access()

Pingback: From $100 Million to Broke to Betting It All on Cryptocurren… | STARTUPS WAVE()

Pingback: From $100 Million to Broke to Betting It All on Cryptocurrencies()