April, 2009

Stability Through Instability

A friend pointed me to a doubly prescient talk given by George Soros in 1994 about his theory of reflexivity in the markets. Essentially Soros notes that there’s feedback in terms of what agents believe about the market and how the market behaves. Not groundbreaking, but he takes this thinking to some logical conclusions which are in contrast to standard economic theory:…

Welcome, Daniel Horowitz and Ace Bailey

Daniel and Ace just joined Emergent Fool as primary authors. You may recognize them from their frequent and insightful comments and hat tips.…

Alfred Hubler on Stabilizing CAS

With his permission, I am posting an email thread between myself and Alfred Hubler. I had contacted him on the recommendation of John Miller when Kevin and I were posting on the possibility of dampening boom-bust cycles in the financial markets through policy or other mechanisms. Here’s what Hubler had to say:…

Physics.Cancer.GOV

Yesterday, from the Director of the National Cancer Institute, addressing one of the two largest cancer research conferences of the year:

NCI commenced a series of workshops that began to bring aspects of the physical sciences to the problem of cancer. We discussed how physical laws governing short-range and other forces, energy flows, gradients, mechanics, and thermodynamics affect cancer, and how the theories of Darwinian and somatic evolution can better help us understand and control cancer.

Read more on my Cancer Complexity Forum post.…

Crowdsourcing Election Verification, part 3

In part 1 I advocated photographing your completed ballot before submitting it and posting your photograph online. Turns out that if you followed this piece of advice in Missouri, you might be in jail right now. Oops! Sorry :-)…

Welcome, Ben Allen

Ben Allen runs the Plektix blog and we’re trying an experiment to see if we can move towards a critical mass of like-minded complexity bloggers. To that end, Ben will be cross-posting his blog entries from Plektix for a while to this blog. If it works out to everyone’s satisfaction we may merge the blogs into one.

Any existing complexity bloggers out there who would like to engage in the same experiment, please let us know.…

Cold Fusion

I remember reading this Wired article in 1998 suggesting that the “debunking” of cold fusion may have been way premature. Last night, 60 Minutes did a pretty convincing piece claiming that more than 20 labs around the world have reported “excess heat” from cold fusion experiments:

Click here for the full story. Watch here.

It’s interesting to me that the best skeptic they could find on the subject (Richard Garwin) was thoroughly unconvincing, simply asserting that there must be a measurement problem, without he himself daring to go measure. You’d think it would be worth a looksy. More interesting still was the independent expert in measuring energy (Rob Duncan) who came in as a total skeptic and came out as a believer.

But my favorite part of the story is near the end when Fleischmann (co-discoverer of cold fusion) appears to be having both a literal and figurative last laugh. Man, what a bad beat he and Pons got.

Besides Garwin, who are the …

If Rafe Were In Charge: Major Medical Edition

Kevin started an interesting discussion that included a thoughtful proposal for the problem of major medical care costs risk mitigation. You should read that here before reading my proposal below.

Part 1: Major Medical Annuities. Federally mandated/funded (similar to SSI/Medicare), with a specific initial lifetime value that is the same for everyone. The concept is that you pick a number slightly bigger than the average expected lifetime major medical bill and set aside that pot of money for everyone individually. At some point (e.g. 65) you can choose to start drawing down from your pot as taxable income. Prior to then, the only way the fund can be used is for major medical expenses not covered by other insurance you may have. Such payments go directly to providers and are tax-exempt. When you die, any leftover amount gets transferred to the MMA accounts of your heirs (per your desired breakdown, or according to probate law in the absence of a will).…

Technology Evolution Will Eclipse Financial Crisis

This is a precursor to Singularity sort of argument:…

Leveraging Taxes for Civil Engagement

Dan Ariely had an interesting idea on NPR’s Marketplace today. Here’s the audio of the segment. The idea is to get tax payers thinking about how their tax dollars should be spent, thus getting them more civilly engaged. His research and that of others suggests that such activity would reduce the propensity to cheat on one’s taxes, and may even get people to pay more than they would otherwise.…

Is the Party Over?

I don’t like the Republican or Libertarian parties. But I’m also no fan of the Democratic party. In fact, I dislike all political parties and think they should be done away with. And while I’m not naive enough to think that this will happen, it makes me glad to see that the “post partisan” utopia is closer today than it was a year ago.…

A Serious Solution to Carbon Emissions

As I’ve made clear before, I remain skeptical that carbon emissions pose a significant marginal threat of climate change. The likely climate sensitivity to CO2 is substantially less than the natural variability over human timescales. Seeing as how temperature trends over geologic time scales are currently downward, I don’t think it’s worth wasting much effort on CO2 reductions.

However, let’s assume for a moment that I’m wrong. What should we do? I don’t think we can actually decrease our energy usage very much and support our civilization. So we have to find non-petroleum energy sources. Biofuel technology doesn’t look very good at the moment. Scaling will require major land use changes that I contend are probably a net negative environmental impact. The cost-benefit for solar does look better, especially in certain geographic areas. But it seems to me the only massively scalable solution at our current level of technology is nuclear fission.…

Microcosmos

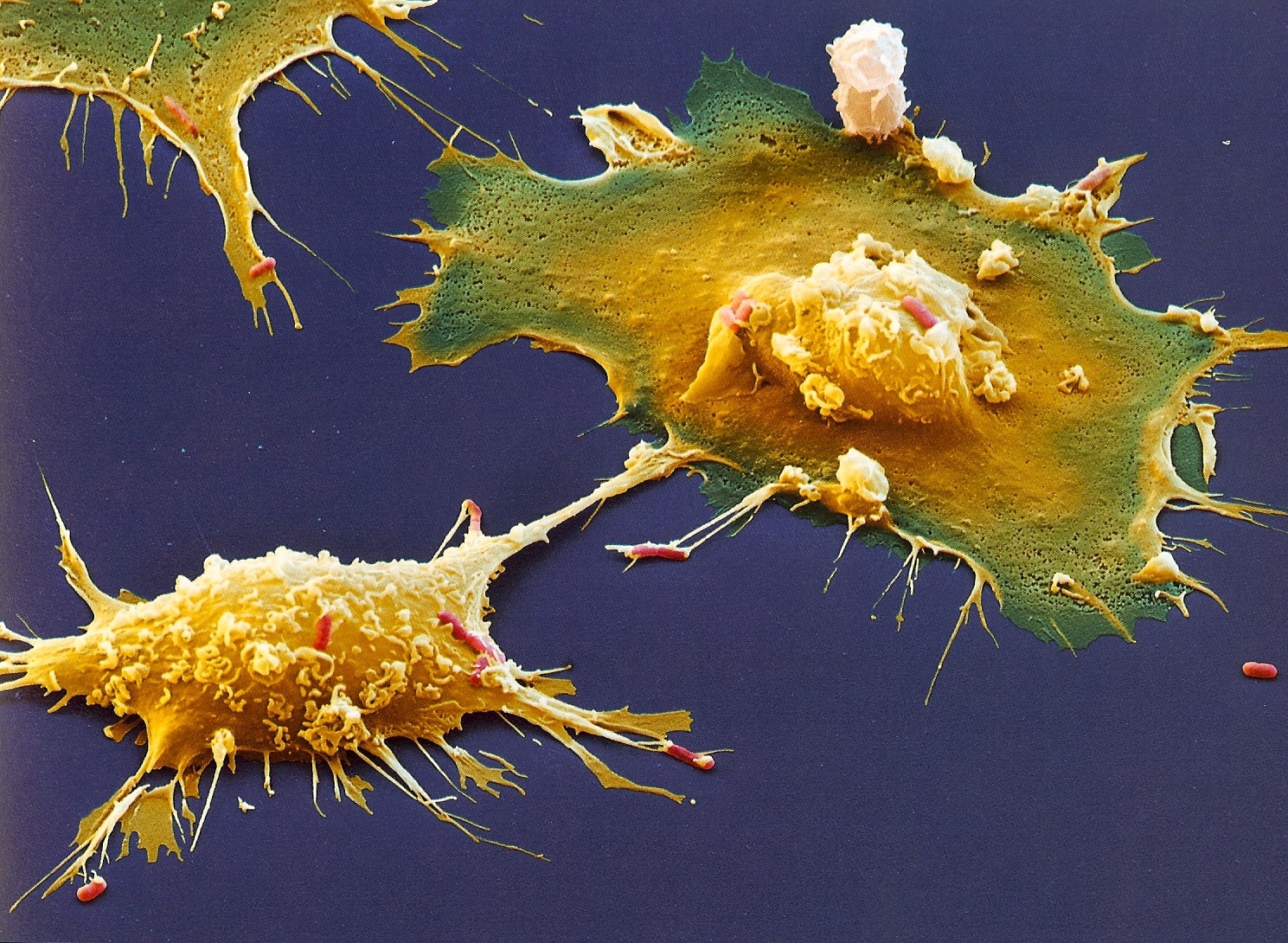

There’s a cool little coffee table book called Microcosmos that features super magnified images of (mostly) living creatures. Here’s a sample:

Macrophage (yellow) chomping on e. coli (red) [3000x magnification]

…

…

Asymmetry Is the Root of All Value

It’s not hard these days to find vignettes like this one (starting at minute 1:45) that describe a microeconomic chain of events that give you a glimpse into the recessionary dynamic. I think it’s a good starting point to explain my personal theory of why asymmetry is the root of all value (economic and otherwise).…

The Vanguard of Science: Bonnie Bassler

The import of this talk goes way beyond the specific and stunning work that Bassler and her team have done on quorum sensing. In my mind, this is the prototype for good biological science:…

Another Must Read on the Origins of the Crisis

Steven Gjerstad and Vernon Smith have published a really nice article that starts out with bubbles in general and goes on to explain why the bursting of this particular bubble hurt the economy so much. It echoes a lot of themes that I’ve covered before, but is obviously much more soundly though out.

The short version is that the effect of a bubble on the economy is determined by its effect on consumer spending. The Dot Com Bubble didn’t have much of an effect because it primarily affected institutions and already relatively wealthy consumers. However, the Fed’s attempt to shorten the resulting recession created a loose monetary policy which forced dollars into the most attractive asset class: homes. This attractiveness stemmed from relaxed lending standards and tax-free capital gains on homes, which created more buyers. But asset appreciation in this class is fundamentally limited by the ability of consumers to repay loans from income, which was not growing fast enough. As the institutions insuring mortgages …

Too Big to Fail = Too Big to Exist?

I asked this question on twitter/facebook and got a lot of variants of “I agree” and only one person who stated disagreement (but provided inadequate reason, IMO). Jay Greenspan put it this way:

Interesting question this morning, and something I’ve been wondering about. I’ve yet to see anyone really argue that state of non-regulation we’ve been in for the last years has been a good idea. I’ve heard some thoughtful conservatives talk about how their views have changed radically — coming to understand that forceful regulation is absolutely necessary.

The super-conservatives I’ve seen are talking more about taxes, avoiding the subject. I’d be very interested to see a credible argument for a hands-off approach.

So how about it, anyone game to take up a considered argument for not mandating that companies who get big enough to affect the global economy should be broken up or otherwise handicapped?…

Executive Compensation

The main problem with executive pay is not that they are compensated too highly, but that there’s not enough pain for them personally when they do a bad job. I propose that the top three executives in all public companies be required to invest 100% of their salary in their own stock each year, with a decaying lockup period before they can sell.…

3 Interesting Articles on The Economy

…The crash has laid bare many unpleasant truths about the United States. One of the most alarming, says a former chief economist of the International Monetary Fund, is that the finance industry has effectively captured our government—a state of affairs that more typically describes emerging markets, and is at the center of many emerging-market crises. If the IMF’s staff could speak freely about the U.S., it would tell us what it tells all countries in this situation: recovery will fail unless we break the financial oligarchy that is blocking essential reform. And if we are to prevent a true depression, we’re running out of time.

Best Reader Comment Award

I’m giving my “2009 Q1 award for most concise, lucid comment” to Paul Phillips for this gem:

…Autocatalysis, Blog Comment, Economics, Incentives, Interconnectedness, Markets, Non-linearity, Stability Autocatalysis, Blog Comment, Economics, Incentives, Interconnectedness, Markets, Non-linearity, Stability, 1