Interventions

Paying Women to Not Get Pregnant

What’s fascinating to me about this is not that it works so well and or that there might actually be support in the Obama administration for doing it on a national scale, but rather that there has not been a backlash against it yet. What are the odds that something like this will actually get implemented? Is it actually a good thing?

hat tip: Annie Duke’s mom…

Methuselah Foundation

If, like Aubrey de Grey, you believe that immortality is achievable, or you are just intrigued by the possibility, you should check out this news story on The Methuselah Foundation.

…

Stability Through Instability

A friend pointed me to a doubly prescient talk given by George Soros in 1994 about his theory of reflexivity in the markets. Essentially Soros notes that there’s feedback in terms of what agents believe about the market and how the market behaves. Not groundbreaking, but he takes this thinking to some logical conclusions which are in contrast to standard economic theory:…

Alfred Hubler on Stabilizing CAS

With his permission, I am posting an email thread between myself and Alfred Hubler. I had contacted him on the recommendation of John Miller when Kevin and I were posting on the possibility of dampening boom-bust cycles in the financial markets through policy or other mechanisms. Here’s what Hubler had to say:…

Crowdsourcing Election Verification, part 3

In part 1 I advocated photographing your completed ballot before submitting it and posting your photograph online. Turns out that if you followed this piece of advice in Missouri, you might be in jail right now. Oops! Sorry :-)…

If Rafe Were In Charge: Major Medical Edition

Kevin started an interesting discussion that included a thoughtful proposal for the problem of major medical care costs risk mitigation. You should read that here before reading my proposal below.

Part 1: Major Medical Annuities. Federally mandated/funded (similar to SSI/Medicare), with a specific initial lifetime value that is the same for everyone. The concept is that you pick a number slightly bigger than the average expected lifetime major medical bill and set aside that pot of money for everyone individually. At some point (e.g. 65) you can choose to start drawing down from your pot as taxable income. Prior to then, the only way the fund can be used is for major medical expenses not covered by other insurance you may have. Such payments go directly to providers and are tax-exempt. When you die, any leftover amount gets transferred to the MMA accounts of your heirs (per your desired breakdown, or according to probate law in the absence of a will).…

Microcosmos

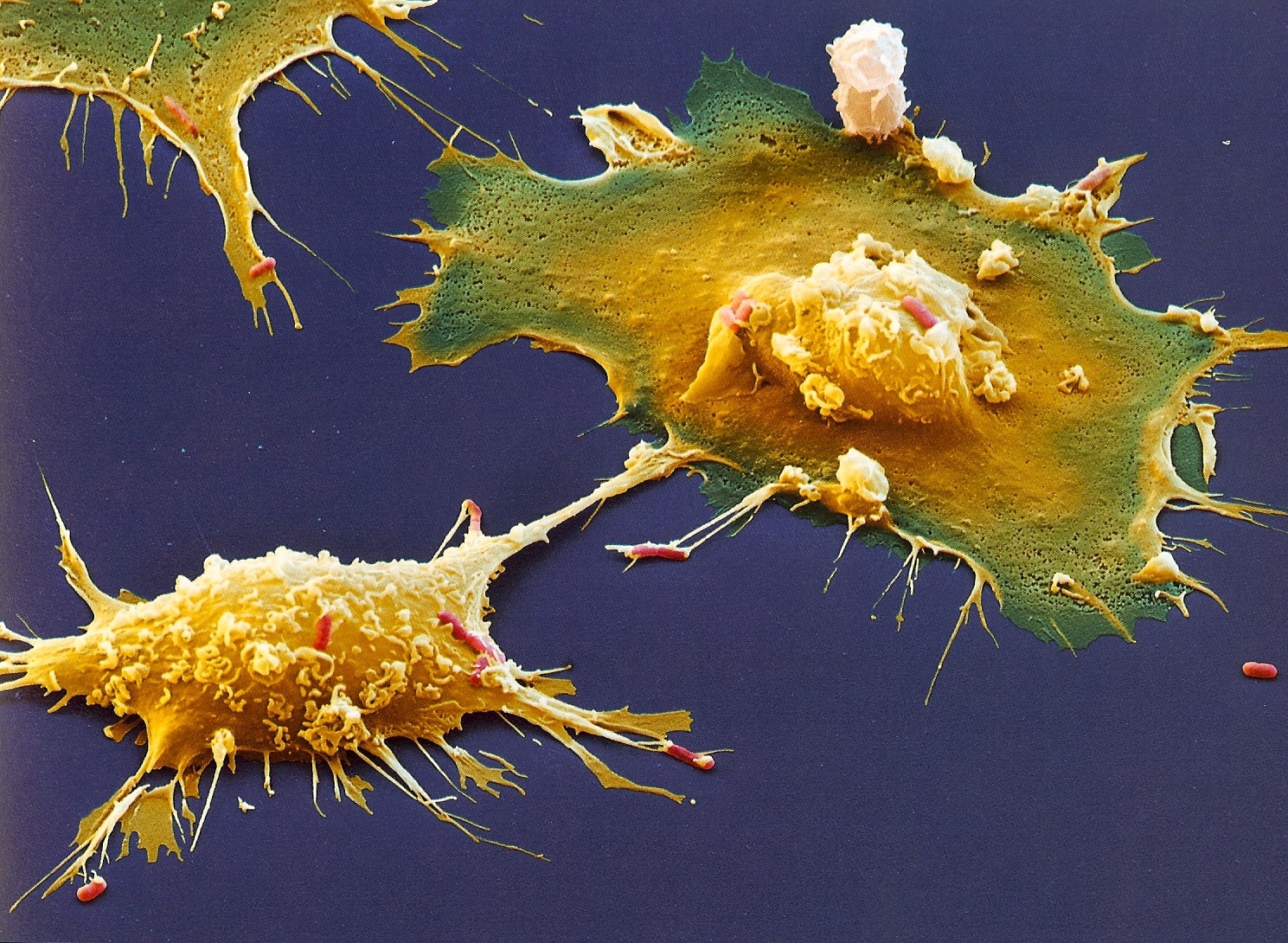

There’s a cool little coffee table book called Microcosmos that features super magnified images of (mostly) living creatures. Here’s a sample:

Macrophage (yellow) chomping on e. coli (red) [3000x magnification]

…

…

Too Big to Fail = Too Big to Exist?

I asked this question on twitter/facebook and got a lot of variants of “I agree” and only one person who stated disagreement (but provided inadequate reason, IMO). Jay Greenspan put it this way:

Interesting question this morning, and something I’ve been wondering about. I’ve yet to see anyone really argue that state of non-regulation we’ve been in for the last years has been a good idea. I’ve heard some thoughtful conservatives talk about how their views have changed radically — coming to understand that forceful regulation is absolutely necessary.

The super-conservatives I’ve seen are talking more about taxes, avoiding the subject. I’d be very interested to see a credible argument for a hands-off approach.

So how about it, anyone game to take up a considered argument for not mandating that companies who get big enough to affect the global economy should be broken up or otherwise handicapped?…

Executive Compensation

The main problem with executive pay is not that they are compensated too highly, but that there’s not enough pain for them personally when they do a bad job. I propose that the top three executives in all public companies be required to invest 100% of their salary in their own stock each year, with a decaying lockup period before they can sell.…

3 Interesting Articles on The Economy

…The crash has laid bare many unpleasant truths about the United States. One of the most alarming, says a former chief economist of the International Monetary Fund, is that the finance industry has effectively captured our government—a state of affairs that more typically describes emerging markets, and is at the center of many emerging-market crises. If the IMF’s staff could speak freely about the U.S., it would tell us what it tells all countries in this situation: recovery will fail unless we break the financial oligarchy that is blocking essential reform. And if we are to prevent a true depression, we’re running out of time.

Decrease Red Meat Consumption

This is not news, health professionals of all sorts have been saying this for a long time. ABC News features a recent study supporting this.

A relevant footnote near the end of the article though:…

Placebos Work Even If You Don't Believe in Them

This is one of the most important medical “breakthroughs” in recent memory. You should read the entire article, because it makes some subtle points, but the upshot is that placebo has (at least) two components, one that is triggered by conscious belief in a putative cure, and another that is triggered by unconscious, Pavlovian association.…

Radical Transparency

In a March 2009 Wired article, Daniel Roth calls for radical transparency in financial reporting as the path to recovery and a more secure financial system. He argues that the reporting requirements today allow companies to obscure what’s going on and that the way to fix things is as follows. Embrace a markup language with which bite-sized chunks of standardly defined pieces of financial data are thrown out to the world so that users can crowdsource the true picture of a company’s financial health.…

Preventing Cancer Through DNA Replacement?

On the Cancer Complexity forum, I pose a question: if we could somehow replace all the damaged DNA in each of the cells of your body with an undamaged copy on a continuous basis, would that prevent you from getting cancer?

What do you think?…

Complexity Economics

In Chasing the Dragon, I wondered aloud whether we could dampen boom-bust cycles in the financial system with an economic equivalent of a controlled burn. Kevin suggested that “generic countercyclical policies” might work. Underlying both mine and Kevin’s thinking is the idea that you can possibly do better (for the world as a whole) by (a) understanding the entire economic system better and (b) enacting policies which are in line with that understanding. In contrast to these assumptions are a point of view articulated by one of the readers on a different thread:…

Chasing the Dragon

Kevin just posted about a great article by Felix Salmon in Wired. I underlined three quotes in my reading of it:

- “Correlation trading has spread through the psyche of the financial markets like a highly infectious thought virus.” (Tavakoli)

- “…the real danger was created not because any given trader adopted it but because every trader did. In financial markets, everybody doing the same thing is the classic recipe for a bubble and inevitable bust.” (Salmon)

- “Co-association between securities is not measurable using correlation…. Anything that relies on correlation is charlatanism.” (Taleb)

Health and Fitness Q&A with Kevin

Whenever I have a question about health matters that is too complex for an MD or academic researcher to get right, I ask Kevin. Nobody I know has a better combination of broad-based current knowledge of the primary literature, plus a whole-system view and understanding of compex dynamics, plus the practical will and experience in living by (and updating) his conclusions.

Here are some questions I had for Kevin recently and his answers.

Rafe: Do the BPA results (such as they are) cause you concern? Do you still use your Nalgene bottle? Would you let your infant or child drink from a plastic bottle or sippy-cup?…

Coffee Linked to Lower Dementia Risk

The NY Times reports.

Here’s my theory: someone who drinks more than three cups of coffee a day can’t possibly sit still and actually gets their ass off the couch and does shit, thereby stimulating the body and brain, a known and powerful way to reduce dementia risk.

hat tip: Daniel Horowitz…

Hina Chaudhry

Like does this mean you can cure heart disease?

She’s hesitant. Nobody wants to say they can defeat the industrialized world’s number one killer. Nobody wants to make promises about life, or quantify salvation. But she fervently believes she’s got a shot.

This is what the 2008 Genius edition of Esquire Magazine had to say about Hina Chaudhry. Her approach is to switch back on the mechanism that causes cells to divide in the heart, which doesn’t normally happen after birth in any mammal. This is not a stem-cell approach, despite what it might sound like.

Looking on the web there appears to be very little written about this work, so I’m wondering how Esquire found her or chose her work to highlight. I’d like to learn more if anyone has information they’d like to share.…