Asymmetry

The Adjacent Possible

Stuart Kauffman has a concept called the Adjacent Possible which I find incredibly useful in understanding the world. Simply put, if you think of the space of possibilities from the present moment forward and just concentrate on those that are achievable today — adjacent to the present moment — that’s the Adjacent Possible.

What’s interesting about possibility-space is that tomorrow’s Adjacent Possible depends on the actions and choices we make today; it’s not symmetric and it’s nonlinear. Certain actions generate more future possibilities than others. In my experience, those actions tend to be the cooperative ones, ones that produce network effects: financial, social and otherwise.

Due to our evolutionary heritage, having come from a resource-constrained world, we may be predisposed to see the more competitive actions which tend to shrink the Adjacent Possible. Whether or not this is a bias or an actual state of affairs, much of our thinking is based on scarcity, so we are drawn to actions that become self-limiting.

Here’s …

The Process

Imagine a multiverse, infinitely infinite. There’s just infinity. Or if you prefer, nothing. There’s no space, no time, no matter, no energy. There’s no structure whatsoever, and nothing “in” any of the universes that make up the multiverse. it’s not even clear whether these individual universes are separate from one another or the same. But since our minds seem finite and we have to start somewhere, let’s imagine them as separate: an infinite collection of universes with nothing in them, no dimension, and no relationship between them.

Now lets assume there is some process for picking out universes from the multiverse. Since there’s no time in the multiverse, the process has no beginning and no end. It’s like a computer program, but it’s infinitely complex. Let’s call it The Process.

If The Process is infinitely complex and has no beginning and no end, what can we know about it? We know that it picks some universes but not others, which effectively creates an “in …

Synthesis of Complexity Theory

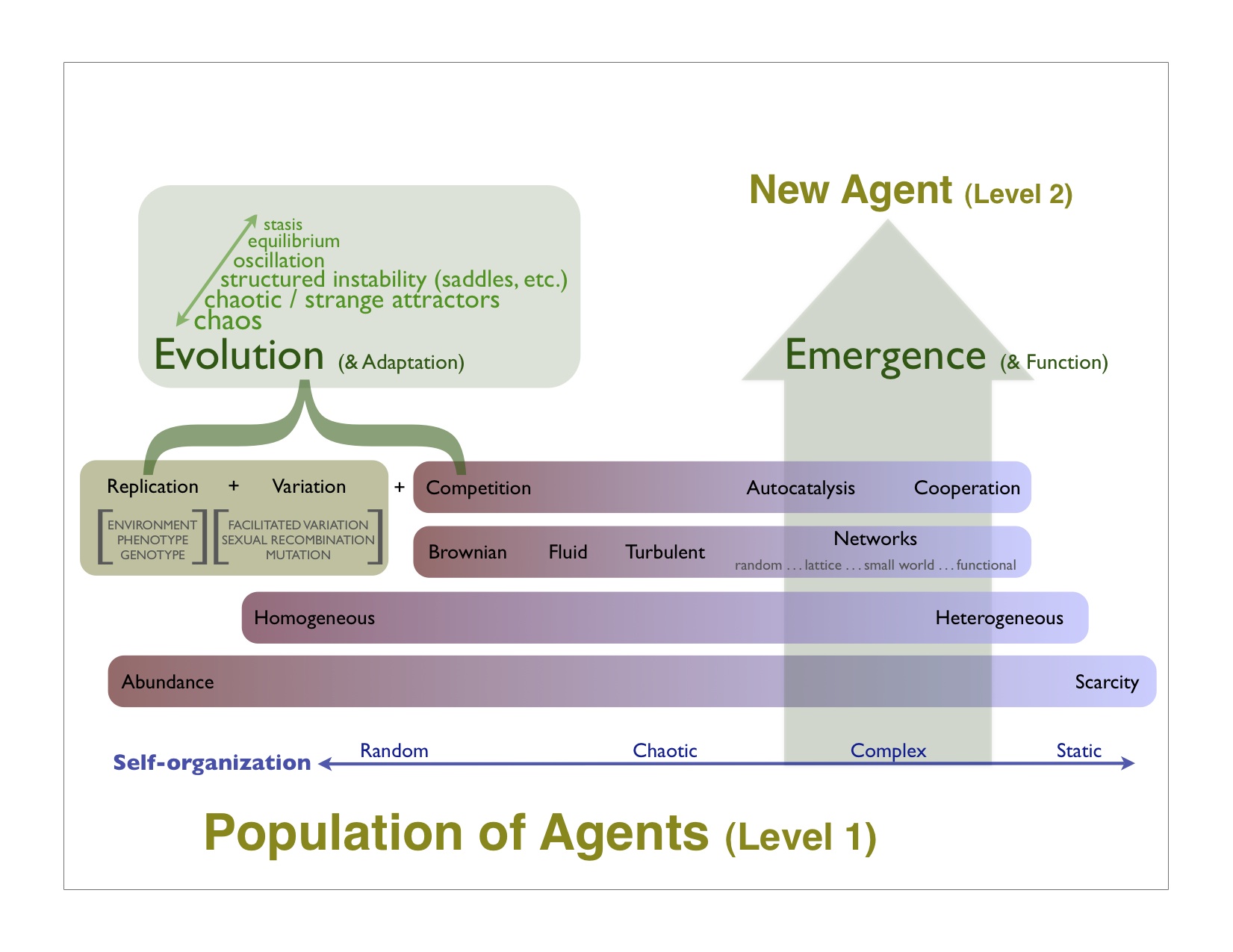

As careful readers of this blog will note, I’ve been obsessed with Alex Ryan’s visualization of the way new levels of organization come into being (e.g. atoms -> molecules -> cells, etc). In an attempt to complement and extend his model, here’s a visualization of how I think of the various concepts coming together:

First off, I know that this may not make sense to most people. The relationships implied by proximity, color, dimension, etc are not totally accurate. The problem is, I’ve reached the limit of my personal ability to create a good visualization. So I’m throwing this out there half-baked hoping that the crowd (that’s you) will help bring this together in a more coherent way.

I’m especially interested in hearing from people who have great design skills. If you don’t, then at the least you can ask probing questions to suss out the sources of confusion, which will then feed into the redesign process.

A more detailed explication of these concepts can …

Inoculating Against the Anti-Vaccine Meme

The debate over vaccination is raging (c.f. Wired article) and it smacks of one of those conundrums that is unlikely to get resolved by scientific inquiry. I offer the following hypothesis and a way out of the dilemma.

Hypothesis: Vaccination is something that is good at the societal level but bad at the individual level. That is, it is a tragedy of the commons. You want all your neighbors to get vaccinated so they don’t pass on the germs to you, but there is enough risk from the vaccination process (at least for certain ones) that you’d rather not do it yourself.

The mathematics of the commons tragedies suggests that there are two ways out. One is to change the payout/incentive structure, in other words, make the vaccine’s less risky to the individual, or at least change the perception of the individual risk (as the Wired article suggests). The problem with manipulating perception is, what if you’re wrong? The marketplace of ideas …

Newcomb's Meta-Paradox

Tweeter, Claus Metzner (@cmetzner) alerted me to this cool area of study with this paper.

Suppose you meet a Wise being (W) who tells you it has put $1,000 in box A, and either $1 million or nothing in box B. This being tells you to either take the contents of box B only, or to take the contents of both A and B. Suppose further that the being had put the $1 million in box B only if a prediction algorithm designed by the being had said that you would take only B. If the algorithm had predicted you would take both boxes, then the being put nothing in box B. Presume that due to determinism, there exists a perfectly accurate prediction algorithm. Assuming W uses that algorithm, what choice should you make?…

Asymmetry Is the Root of All Value

It’s not hard these days to find vignettes like this one (starting at minute 1:45) that describe a microeconomic chain of events that give you a glimpse into the recessionary dynamic. I think it’s a good starting point to explain my personal theory of why asymmetry is the root of all value (economic and otherwise).…